An unnamed victim of deceased child sex predator Jeffrey Epstein, as well as the government of the U.S. Virgin Islands, will be allowed to file suit against JPMorgan Chase and Deutsche Bank.

United States District Judge Jed Rakoff tossed most of the charges against the two financial institutions in proposed class action lawsuits on Monday, according to a report from Bloomberg, and threw out three of the four claims against JPMorgan Chase in a separate suit from the U.S. Virgin Islands. Attorneys will be permitted, however, to contend that the firms benefited from the Epstein sex trafficking scheme by providing him with financial services.

“Epstein’s sex trafficking operation was impossible without the assistance of JPMorgan Chase, and later Deutsche Bank, and we assure the public that we will leave no stone unturned in our quest for justice for the many victims who deserved better from one of America’s largest financial institutions,” lawyers for the U.S. Virgin Islands and the Epstein victim, identified only as Jane Doe, said in a statement.

The lawsuit from Doe contends that Epstein, who ran a hedge fund before his suicide in 2019, was granted special treatment from JPMorgan Chase because he attracted clients to the investment bank. Epstein worked with the company between 1998 and 2013, after which most of his business went to Deutsche Bank.

An earlier lawsuit from former U.S. Virgin Islands Attorney General Denise George noted that JPMorgan Chase continued working with Epstein even after he pleaded guilty to two counts of soliciting prostitution from a teenage girl in 2008. George was dismissed from her post by U.S. Virgin Islands Governor Albert Bryan days after she submitted the lawsuit.

Jes Staley, a former senior executive at JPMorgan Chase and the former chief executive of Barclays, allegedly exchanged more than 1,200 emails with Epstein, some of which reportedly made reference to young women and vacations to Little St. James, the private estate in the U.S. Virgin Islands owned by Epstein. JPMorgan Chase filed suit against Staley earlier this month, contending that he should be held responsible for damages to the company should any claims from Doe or the U.S. Virgin Islands be upheld in court. Staley is scheduled to be deposed on Thursday.

“We are pleased that the U.S. Virgin Islands will continue to work alongside survivors to hold JPMorgan Chase accountable for enabling Jeffrey Epstein’s heinous sex-trafficking venture,” U.S. Virgin Islands Acting Attorney General Carol Thomas-Jacobs said in a statement, according to a report from CNBC. “This case is critically important to ensuring that financial institutions do their jobs, with the detailed, real-time information available to them, as a first line of defense in identifying and reporting potential human trafficking, as the law expects.”

Epstein purchased Little St. James in 1998 and owned the property until he died in 2019. The island has allegedly hosted former President Bill Clinton and British Prince Andrew, while a pilot who formerly worked for Epstein testified that he had seen the two individuals, as well as former President Donald Trump, lawyer Alan Dershowitz, and actor Kevin Spacey, on the deceased predator’s aircraft. Little St. James has acquired nicknames such as “Pedophile Island.”

CLICK HERE TO GET THE DAILY WIRE APP

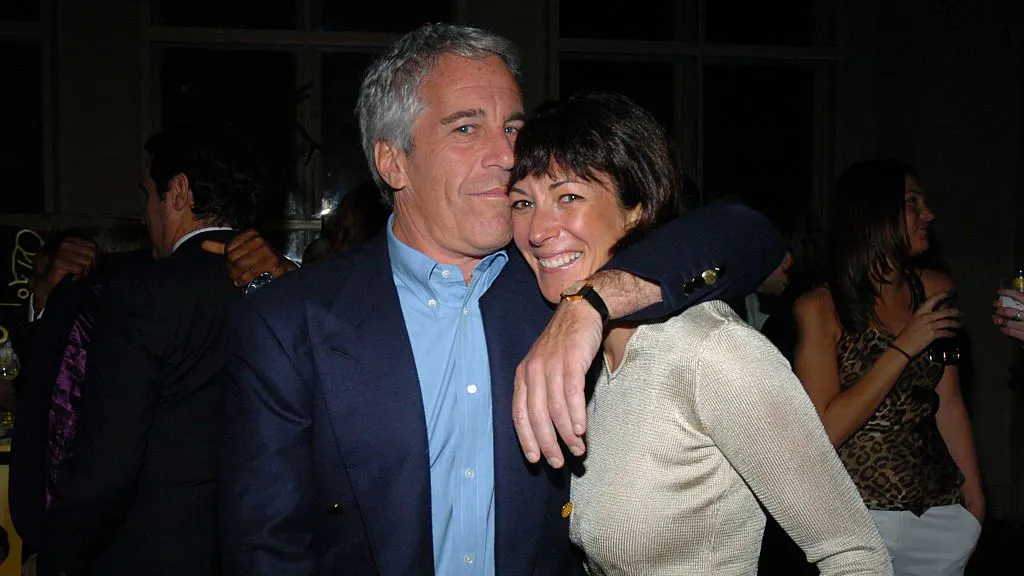

The lawsuits against JPMorgan Chase and Deutsche Bank come months after Ghislaine Maxwell, a longtime companion of Epstein, was sentenced to 20 years in prison on multiple conspiracy and sex trafficking charges for aiding Epstein in recruiting and grooming young girls. Maxwell was accused of “normalizing” the abuse by undressing in front of a victim, discussing sexual topics with other victims, and prompting them to give “sexualized massages” to Epstein, according to a federal indictment. She allegedly tried to befriend victims by taking them on shopping excursions and asking about their lives.

.png)

.png)