The Texas Permanent School Fund (PSF) opted on Tuesday to terminate an $8.5 billion investment with BlackRock Inc., with one official citing the financial asset manager’s support of environmental, social, and governance (ESG) proposals.

State Board of Education Chairman Aaron Kinsey said in a statement that PSF’s “relationship with BlackRock was not in compliance” with legislation enacted in 2021 that “prohibits state investment in companies like BlackRock that boycott energy companies.”

PSF “has a fiduciary duty to protect Texas schools by safeguarding and growing the approximately $1 billion in annual oil and gas royalties managed by the Texas General Land Office,” Kinsey said, adding that terminating BlackRock’s contract “ensures PSF’s full compliance with Texas law.”

BlackRock, which boasts trillions of dollars in assets, endured divestments by other GOP-led states amid objections over its push for ESG that critics view as being part of a “woke” agenda. But the company has pared back support for ESG proposals while acknowledging such investments could hurt its bottom line.

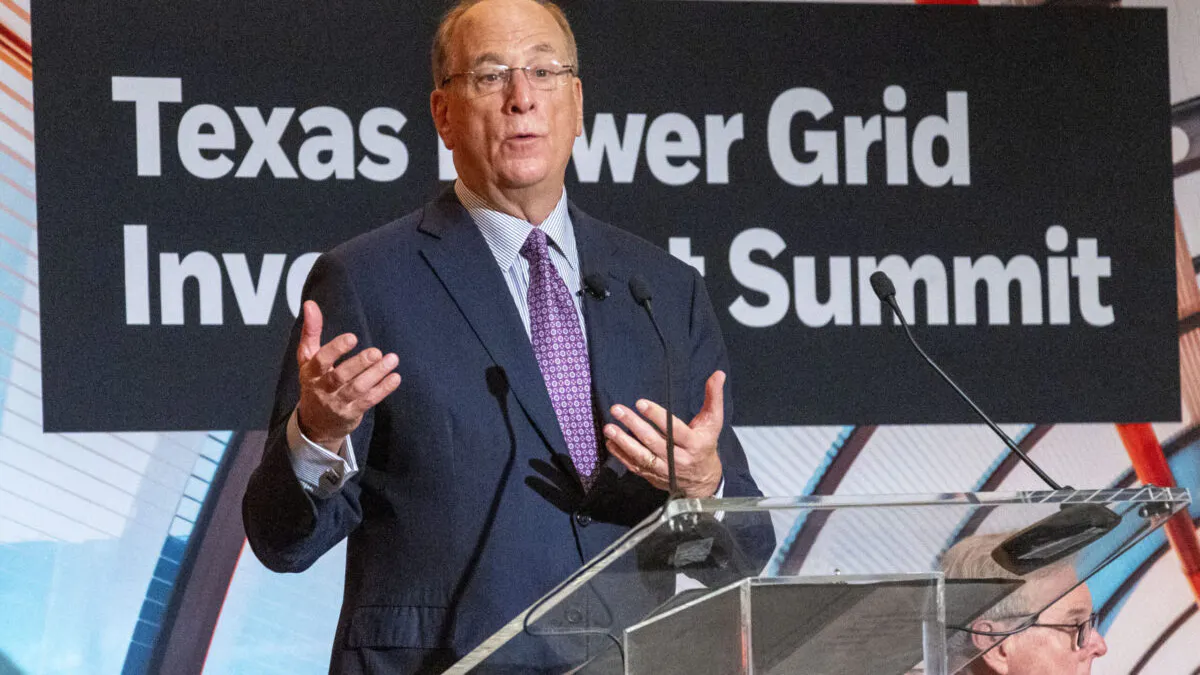

In a statement, BlackRock said it is “helping millions of Texans invest and save for retirement.” It added, “On behalf of our clients, we’ve invested more than $300 billion in Texas-based companies, infrastructure and municipalities, including $125 billion invested in the energy sector, including a $550 million joint venture with Occidental. We recently hosted an energy summit in Houston designed to explore how to strengthen Texas’ power grid.”

A letter that PSF sent to BlackRock, a copy of which was posted to X by a reporter with The Texan, said the termination of the contract was effective on April 30 and noted requests for the company to “cooperate” in transitioning assets to a successor manager and work in “good faith” to determine and execute “the most efficient and cost-effective transition plan for the assets.”

CLICK HERE TO GET THE DAILYWIRE+ APP

Kinsey said BlackRock’s “dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy and the very companies that generate revenues for our PSF. Texas and the PSF have worked hard to grow this fund to build Texas’ schools. BlackRock’s destructive approach toward the energy companies that this state and our world depend on is incompatible with our fiduciary duty to Texans.”

He added, “Today represents a major step forward for the Texas PSF and our state as a whole. The PSF will not stand idle as our financial future is attacked by Wall Street. This bold action helps ensure our PSF remains in fact permanent and will continue to support bright futures and opportunities for generations of Texas students.”

.png)

.png)

.png)