Unemployment is expected to soar to 15% during the second quarter of the year, while the U.S. gross domestic product (GDP) is set to plunge by 34% as the coronavirus slams the nation’s economy, according to a forecast by Goldman Sachs released on Tuesday.

The new forecast, titled “The Sudden Stop: A Deeper Trough, A Bigger Rebound,” was published on Monday and says it is “making further significant adjustments to our GDP and employment estimates. We now forecast real GDP growth of -9 percent in Q1 and -34 percent in Q2 … (vs. -6 percent and -24 percent previously) and see the unemployment rate rising to 15 percent by midyear (vs. 9 percent previously).”

The investment bank’s previous report, headlined “A Sudden Stop for the U.S. Economy,” had predicted only a 24% drop in the GDP for the second quarter (which includes April, May and June). That report predicted the unemployment rate jumping to 9%.

“This not only means deeper negatives in the very near term but also raises the specter of more adverse second-round effects on income and spending a bit further down the road,” the Goldman Sachs analysis noted.

The unemployment rate skyrocketed last week, with a record-setting 3.3 million initial jobless claims, nearly five times the highest on record.

But the latest forecast offered a glimmer of hope, predicting a “V-shape” recovery in which the plunge will be followed by a spike. “Our estimates imply that a bit more than half of the near-term output decline is made up by yearend and that real GDP falls 6.2% in 2020 on an annual-average basis (vs. 3.7% in our previous forecast),” the forecast said.

Goldman Sachs also said the $2.2 trillion economic relief package passed by Congress last week should help alleviate longer-term problems. “Both monetary and fiscal policy are easing dramatically further, which will tend to contain these second-round effects and add to growth down the road,” the said.

Meanwhile, James Bullard, president of the St. Louis Fed, said in an interview with Bloomberg TV on Monday that things may be even worse.

“If you read the blog carefully, you’ll see that there is a way to bound the unemployment rate – it’s going to be somewhere between 10 percent and, I think, the upper bound is around 42 percent,” he said, according to Epoch Times.

The Fed’s “back-of-the-envelope” calculations use two different models to give optimistic and pessimistic estimates, and show a second-quarter jobless rate ranging from 10.5 percent to 40.6 percent, with 27.3 million jobs lost at the lower bound and 66.8 million in the upper limit.

Fed analysts averaged the two, for a most likely outcome of 47.05 million people losing their jobs in the second quarter.

“Summing to the initial number of unemployed in February, this resulted in a total number of unemployed persons of 52.81 million. Given the assumption of a constant labor force, this resulted in an unemployment rate of 32.1 percent,” Fed economist Miguel Faria-e-Castro wrote.

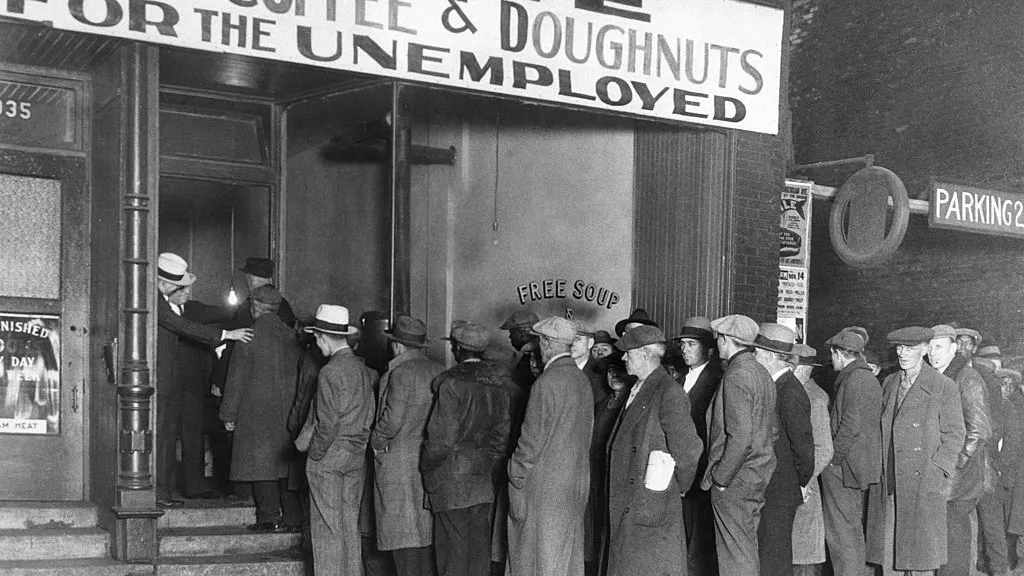

In 1933, the height of the Great Depression, the unemployment rate hit 24.9%, according to The Balance. It remained above 20% for the next two years, and remained in the mid- to high-teens until 1940. By 1943, in the middle of World War II, the rate dropped to 1.9%.

.png)

.png)