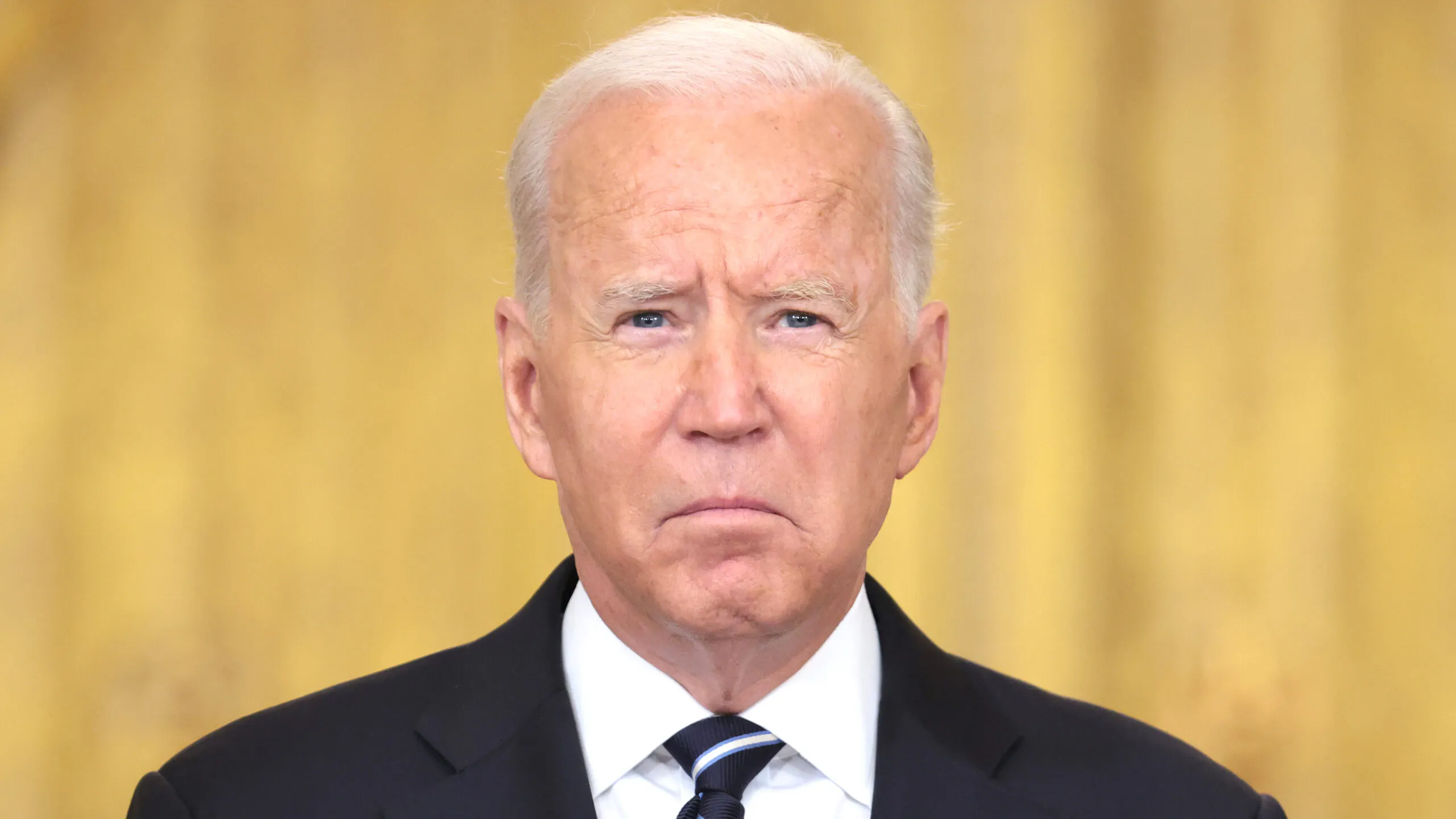

The number of GOP-led states which assert they will not comply with the Biden administration proposal — which would force banks to hand over the aggregate transaction data for accounts with over $600 to the IRS — is starting to mushroom.

On Wednesday, after West Virginia and Nebraska had already indicated they would not comply, Missouri state treasurer Scott Fitzpatrick asserted, “I will stand up to this government overreach and protect the privacy of those account holders. Turning over their transaction data to the federal government is illegal under Missouri law and a gross violation of Missourians’ expectation of privacy when it comes to their personal financial records. I will not turn this information over to the IRS voluntarily and will fight in court to block any attempt by the federal government to compel my office to comply with this mandate.”

Arkansas state treasurer Dennis Milligan echoed to the Daily Mail, “It would be absolutely absurd for me to turn over their private account data regarding money they’re saving for their loved ones’ future to the IRS, and I do not intend to do so. I would do all I could in my role to not comply with this proposal.”

West Virginia state treasurer Riley Moore said of the IRS plan, “The impact this is going to have on community banks, this is like Dodd Frank on steroids. In terms of compliance, a community bank, to be able to be in compliance, to set that type of regime up is just going to put them out of business. So who wins? The big banks win. The same banks that were bankrolling Biden’s campaign in 2020.” He added, “The $600 requirement is absolutely unconstitutional. It’s a massive invasion of privacy; it’s huge government overreach. I don’t think any state should comply with this.”

Last week Nebraska Treasurer John Murante told Fox News, “My message is really simple. The people of Nebraska entrusted me to protect the privacy of these accounts and I am not going to comply with this. If the Biden administration sues me, we will take it all the way to the Supreme Court. We are going to fight every step of the way.”

Moore lauded Murante, saying, “I think it’s great what Treasurer Murante said. I think we should all follow suit in our respective states by not complying with this. If the feds feel like they wanna sue every state that’s not complying with it, then okay. Bring it on.”

Consumers Bankers President Richard Hunt told Fox News, “Now that they have the data, they are going to slice and dice and look into every single transaction of nearly every American. I’m afraid if it does pass it may force some people not to get into the banking system, and we need people in the banking system.”

On September 20, a number of state treasurers, auditors, and financial officers signed an open letter to President Biden and Treasury Secretary Janet Yellen, which stated:

As State Treasurers, Auditors and financial officers, we are joining together with our local citizens’ community banks and credit unions to express our opposition to any proposal that would require financial institutions to turn over private citizens’ personal bank account information to the Internal Revenue Service (IRS) if they exceed $600 of inflows or outflows in an account.

We do not believe the federal government should give the IRS the unprecedented and unconstitutional power to peer into law abiding citizens’ private financial accounts. This would be one of the largest infringements of data privacy in our nation’s history and is a direct assault on the financial disclosures of all Americans.

.png)

.png)