During the recent Politicon debate between Cenk Uygur and Ben Shapiro, a lot of time was spent discussing tax policy, and the pros and cons of setting tax rates at different levels. At one point, Uygur responded to Shapiro’s claim that tax revenue is at an all time high by stating:

So when you say tax revenue is at its highest point, now you know that that is misleading because everything economically is at its highest point, meaning that we have a lot more people in the country than we did in the 1950s and 1960s, so hence we are collecting more overall taxes. But, the reality is, as a percentage it is clearly down, the top tax bracket now is around 39%, it used to be at 91%, that’s inarguable right? … To say that it [tax revenue] is at record collection is misleading.

Cenk is right that measuring things in terms of total dollars doesn’t mean much, if for no other reason than population growth alone would keep resulting in record-high tax collection. But the rationale behind Cenk’s argument, that contemporary tax receipts must be lower in population-adjusted, inflation-adjusted, and growth-adjusted terms simply because the rates that exist in the law today are lower than they were before is itself very flawed, and actually flat-out incorrect. There is a very simple way to measure how much of our national output the Federal government is collecting, and has collected historically in this country — by looking at Federal tax receipts as a percentage of Gross Domestic Product.

As I’ve written previously at Red State, “according to data supplied by the Federal Reserve Bank of St. Louis, all Federal tax receipts (from income, to payroll, to business taxes) as a percentage of GDP were just above 13% in 1950, and hit a short-term peak of about 18% in 1952, before coming in below that percentage every year until 1969. The highest percentage for any single year from 1950-2016 was the year 2000, during the end of the 1990s economic boom, when Federal tax receipts reached 19.69% of GDP.” By 2015, we were back to collecting almost 18% of GDP through Federal taxes, and in 2016 it was 17.54%.

The average for 1950-2016 was about 16.9% of GDP collected as Federal taxes, meaning we are currently collecting slightly more than we have on average since 1950. The primary driver of spikes and drops in the percentage over the years has been cyclical changes in the health of the economy. When the economy is booming it tends to go higher, and vice versa.

People are often surprised to hear this, since they’ve assumed that because marginal income tax rates were higher on everyone up and down the income spectrum in the 1950s/1960s, that surely taxes must have taken a larger share of our national income than they do today. The reason why this isn’t the case, however, is because it was easier to avoid paying taxes back in the 1950s, especially for rich people. Tax shelters, loopholes, deductions, tax-free securities, and so forth made the tax code the equivalent of Swiss cheese.

This is why the alternative minimum tax was introduced in 1969, and why loopholes were tightened that year and again in 1986. When Cenk and other progressives claim that we’ve tried taxing high income individuals at 91%, and that nothing bad happened as a result of doing so, they’re ignoring the fact that we never truly taxed people at those rates. Effectively, the tax burden in this country was never that high for anyone who could afford an accountant, or was willing to game the system. The reality is, we simply do not know how disastrous the economic effects of ultra high marginal tax rates like 91% would be for the economy, at least from experience.

Of course, what progressives are really worried about is how the tax burden in this country is distributed. Sure, America as a whole may not have seen a tax cut over the decades, but what does the tax burden look like for high income people specifically? Aren’t they getting away with paying less than their “fair share” of taxes?

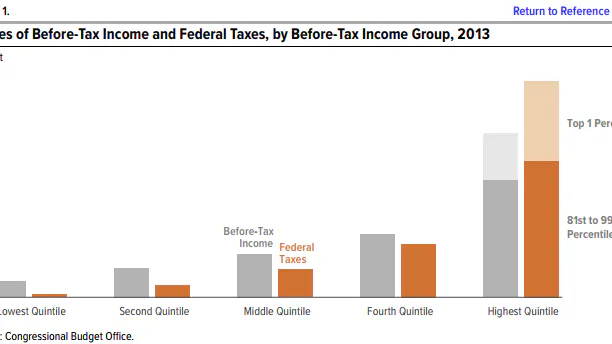

That certainly is not the case today. In June of last year, the Congressional Budget Office published a report titled “The Distribution of Household Income and Federal Taxes, 2013.” That year was the first year after the Bush tax cuts expired on the highest income Americans, and no parts of the tax code have been changed much, if any, since then. The report looks at all “individual income taxes, payroll (or social insurance) taxes, corporate income taxes, and excise taxes” and breaks down what different income brackets paid relative to the share of the national income they took home. And to be clear, let’s repeat something — these results include payroll taxes. They were not calculated with income taxes alone, which are highly progressive. In fact, the calculations even exclude estate taxes, which are taxes paid only by wealthy households once an estate is passed onto heirs.

As you can see in the above chart taken from the CBO’s report, the top two quintiles, and the top percentage of income earners specifically, paid for a greater share of all Federal tax receipts (orange bars) than they received in before-tax income (silver bars). In fact, the top 20% of income earners alone paid close to 70% of all Federal taxes, while earning just over 50% of all income.

The average effective Federal tax rate for someone in the top percentage of income earners was 34% (if you live in a state like California or New York, that percentage gets much higher once state and local taxes are added). It was 23.2% for those between the 80th and 99th percentiles, and was 13.8% for the middle three quintiles (the “middle class”). The bottom quintile, the 20% of Americans with the lowest incomes, paid an effective tax rate of just 3.3% to the Federal government, primarily because the money they received back from negative income taxes offset much of their payroll tax burden. It’s clear that America has a very progressive tax system.

Even as a conservative, I have no issue with high-income Americans carrying a larger load. In disagreement with many fellow members of the Right, I actually support a progressive tax system. However, any notion that those making a lot of money don’t pay their “fair share” is both insulting and flatly idiotic. Everything the Federal government does nowadays is paid for almost exclusively by upper-middle class and wealthy Americans (the top two quintiles carry almost all of the burden). Maybe progressives should thank them every now and then instead of demonizing them for their success.

.png)

.png)