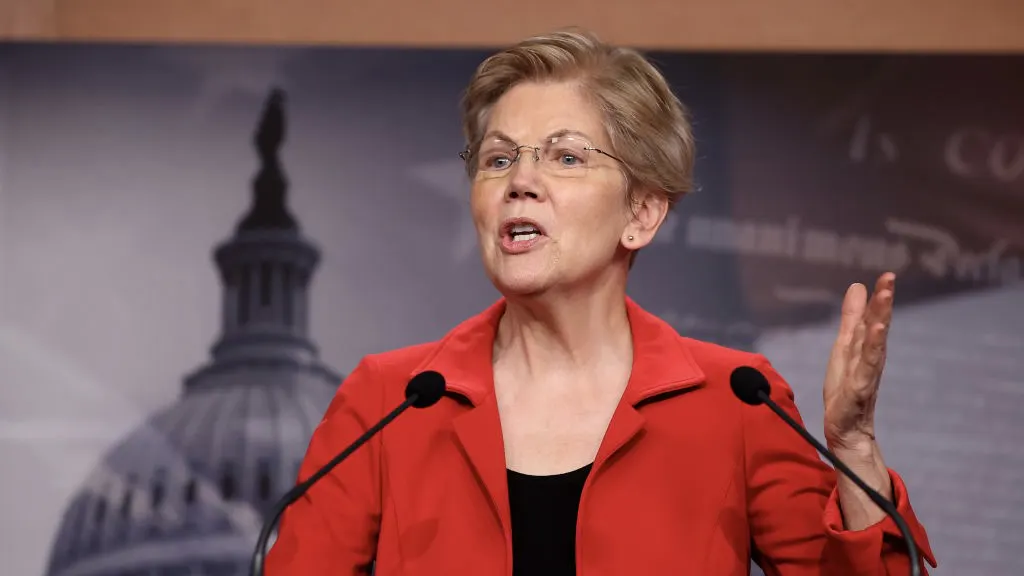

On Monday morning, Senator Elizabeth Warren of Massachusetts (D) proposed a new tax bill, alongside Washington Representative Pramila Jayapal (D) and Pennsylvania Representative Brendan Boyle (D), that would reportedly place a tax on “ultra-millionaire” net worths and households.

The legislation is co-sponsored by socialist Senator Bernie Sanders (I-VT), among others, and has similarities to Warren’s plans that she laid forth in the 2019 Democratic primary.

CNN reports, “Taxing the rich served as a primary way for Warren and Sanders to fund their plans to expand health coverage, child care and other proposals when they were vying for the primary nomination.”

The tax would reportedly place a 2% yearly tax on the net worth of households and trusts above $50 million. Any households and trusts that have a net worth over $1 billion would have to pay another 1% annual surtax. This would leave billionaires with a total tax of 3%.

Bloomberg Wealth reports on the individual billionaires that would potentially be affected by such a tax:

“Jeff Bezos, the world’s richest person, would face an extra tax charge of at least $5.4 billion in 2021 if the bill became law, while Elon Musk would pay $5.2 billion, according to a Bloomberg analysis. The measure would cost Bill Gates an additional $4 billion and Mark Zuckerberg would have to fork over $2.9 billion to cover the tax.”

Senator Warren released a statement about the bill, saying,

“The ultra-rich and powerful have rigged the rules in their favor so much that the top 0.1% pay a lower effective tax rate than the bottom 99%, and billionaire wealth is 40% higher than before the COVID crisis began. A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations. As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate. This is money that should be invested in child care and early education, K-12, infrastructure, all of which are priorities of President Biden and Democrats in Congress. I’m confident lawmakers will catch up to the overwhelming majority of Americans who are demanding more fairness, more change, and who believe it’s time for a wealth tax.”

According to information collected and put forth by the legislators, approximately 100,000 American families would be responsible for paying the tax, and it would reportedly provide around $3 trillion over ten years.

There is speculation as to whether or not the act of taxing wealthy citizens is constitutional. President Biden did not push for a wealth tax during the primaries and is reportedly not in favor of such a tax.

At a press briefing on Monday, White House Press Secretary Jen Psaki was asked if Biden had “any appetite for a wealth tax.” Psaki said that the president “believes the ultra-wealthy and corporations need to finally start paying their fair share” and that the economy and tax system need to “reward work not wealth.”

Psaki stated that the president is focused on the Covid relief bill at the moment, but added, “Addressing the inequities in the tax code is something he talked about as part of his Build Back Better agenda and is something he remains committed to. He has a lot of respect for Senator Warren and is aligned on the goal of ensuring the ultra-wealthy and big corporations finally pay their fair share. He’s laid out a lot of ideas and when we get to that point in our agenda, he’ll look forward to working with her and others in Congress.”

.png)

.png)