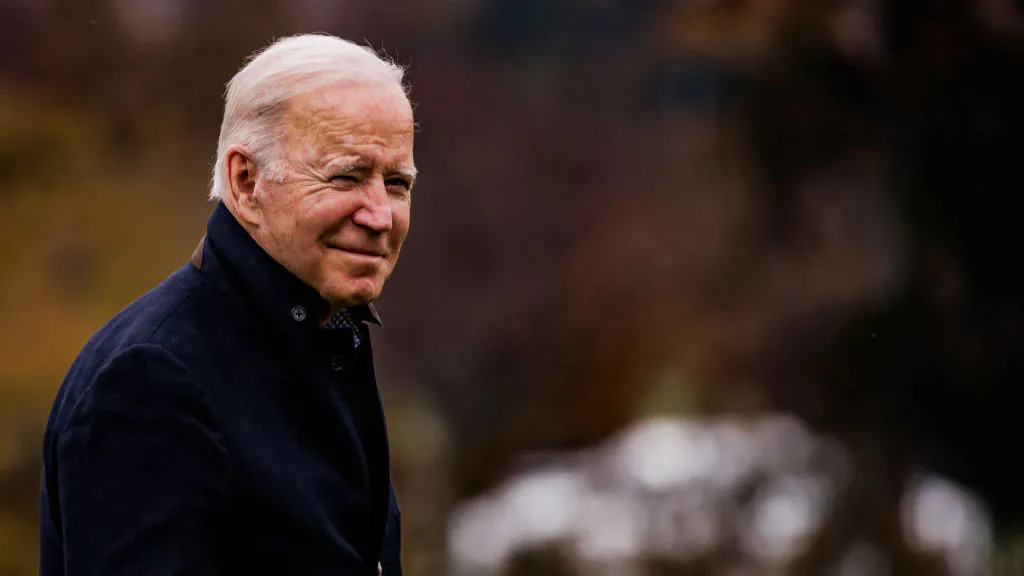

President Joe Biden’s Build Back Better legislation, which passed in the House on Friday, includes a multi-billion dollar tax cut for wealthy Americans in blue states while hitting a wide swath of the middle-class with a tax hike.

The House passed Biden’s social spending bill and the cornerstone in his Build Back Better agenda on Friday morning. The bill includes provisions that hike state and local tax deductions, which overwhelmingly favor Democrat-run states, while raising taxes on up to 30% of middle-class earners.

In 2017, then-President Donald Trump signed a tax bill into law that placed a $10,000 cap on the amount of state and local taxes that one could deduct from their federal tax bill. Prior to the cap, one could deduct essentially all state and local taxes (SALT) from the federal tax bill. The cap is set to expire in 2025.

Biden’s social spending bill raises the SALT cap to $80,000 until 2031 before dropping back down to $10,000, according to The Washington Post. The benefits of such a maneuver would accrue mostly to wealthy individuals living in deep blue, high tax states.

According to a 2017 report on SALT deductions by the Tax Foundation: “The state and local tax deduction … expressly favors higher-income earners and state and local governments which impose above-average tax burdens. The deduction’s effect is for lower- and middle-income taxpayers to subsidize more generous spending in wealthier states like California, New York, and New Jersey, reducing the felt cost of higher taxes in those states.”

In total, the SALT cap raise in Biden’s Build Back Better legislation is equivalent to a “$285 billion tax cut that would almost exclusively benefit high-income households over the next five years,” according to the Post.

At the same time, the social spending bill also targets the middle class, hiking taxes on 20% to 30% of households making less than $400,000 a year. As The Daily Wire reported:

The Biden administration’s “Build Back Better” spending bill would raise taxes on many middle-class families, according to a report from the nonpartisan Tax Policy Center, despite the president’s promise to not raise taxes on anyone making [less] than $400,000 per year.

The report found that in the year 2022, when looking at direct taxes only — that is, individual income taxes and payroll taxes — most American families in all income groups except the top 1% would see a tax cut. But when all of the major tax laws are taken into account, TPC reports that “roughly 20 percent to 30 percent of middle-income households would pay more in taxes in 2022.” Those increases would be small, with most low and middle-class families paying about $100 more in taxes.

Biden, both during his campaign and as president, has pledged to not raise taxes on the middle class. White House Press Secretary Jen Psaki repeated the claim in April while fielding questions on Biden’s domestic agenda.

.png)

.png)