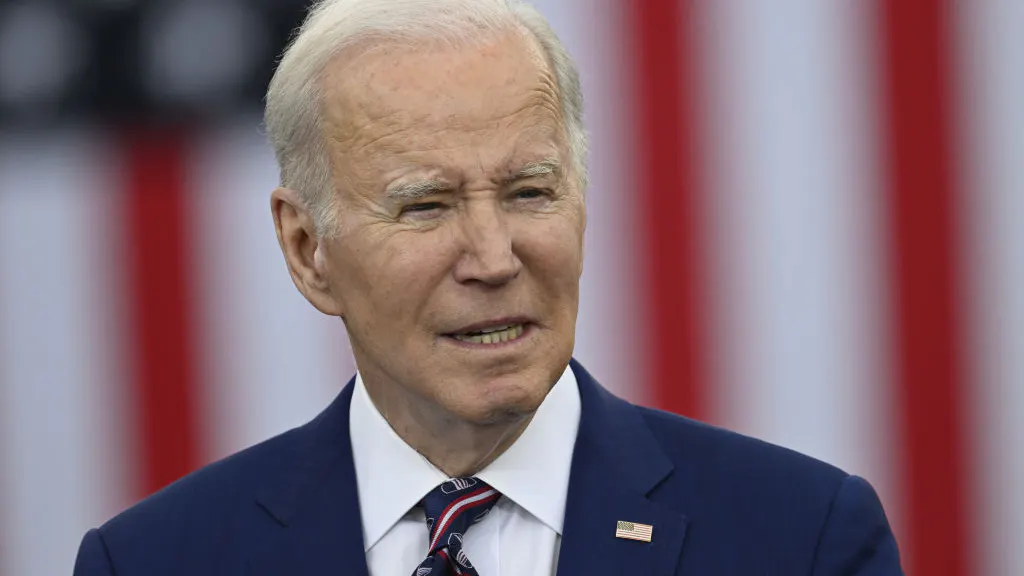

President Joe Biden asserted on Friday that his administration has achieved significant “progress” with combating price levels, even as inflation rates remain between three times and four times higher than at the start of his term.

Inflation as measured by the Personal Consumption Expenditures Price Index reached a 5.0% rate as of February 2023, according to data from the Commerce Department, marking a decrease from the 7.0% rate recorded in June 2022, but a significant increase from the 1.5% rate seen in January 2021, when Biden gained control of the White House.

The commander-in-chief nevertheless celebrated the development, noting that annual inflation has fallen by 30% from last summer, but failing to mention the overall surge in price pressures since he assumed office. “We are making progress in the fight against inflation,” he commented in a statement. “The fight against inflation isn’t over, and every day my Administration is working to give families more breathing room.”

The Consumer Price Index, another key metric used to track price levels, meanwhile reached 6.0% in February 2023, according to data from the Bureau of Labor Statistics. The rate is more than four times higher than the 1.4% level observed in January 2021, but lower than the 9.1% heights charted in June 2022.

Biden added that his efforts to reduce prescription drug expenses and encourage the domestic manufacturing sector have been responsible for the marginally lower inflation over the past several months. “Just as we are working to bring costs down, we are working to build America up,” he continued. “We should continue to invest in America from the middle out and the bottom up. This is not the time to turn back to trickle-down economics by cutting American manufacturing and other critical programs American families count on.”

Inflation has a more severe impact on low-income households, which typically allocate a greater portion of their monthly income to core living expenses relative to wealthier families. Real wages plummeted 1.9% between February 2022 and February 2023, according to more data from the Bureau of Labor Statistics.

Policymakers at the Federal Reserve have increased target federal funds rates over the past year to combat the persistent inflationary pressures. The collective rise in interest rates from near-zero levels has shocked the financial sector: Silicon Valley Bank was recently forced to sell long-term government securities and corporate bonds at a loss due to the higher rates as executives sought to fund withdrawals, leading to the company’s implosion.

Federal Reserve Chair Jerome Powell had told lawmakers days before the collapse that officials intended to continue raising the target federal funds rate. Monetary policymakers announced a quarter-point rate hike last week.

CLICK HERE TO GET THE DAILYWIRE+ APP

One study from National Bureau of Economic Research analysts revealed that more restrictive policy from the Federal Reserve has caused the overall financial system’s assets to fall 10% from their original book value. The “substantial losses in the value of banks’ long-duration assets” indicate that “banks are much more fragile” to sudden mass withdrawal requests from their customers, particularly in financial institutions where a majority of deposits exceed the $250,000 threshold backed by the Federal Deposit Insurance Corporation.

.png)

.png)