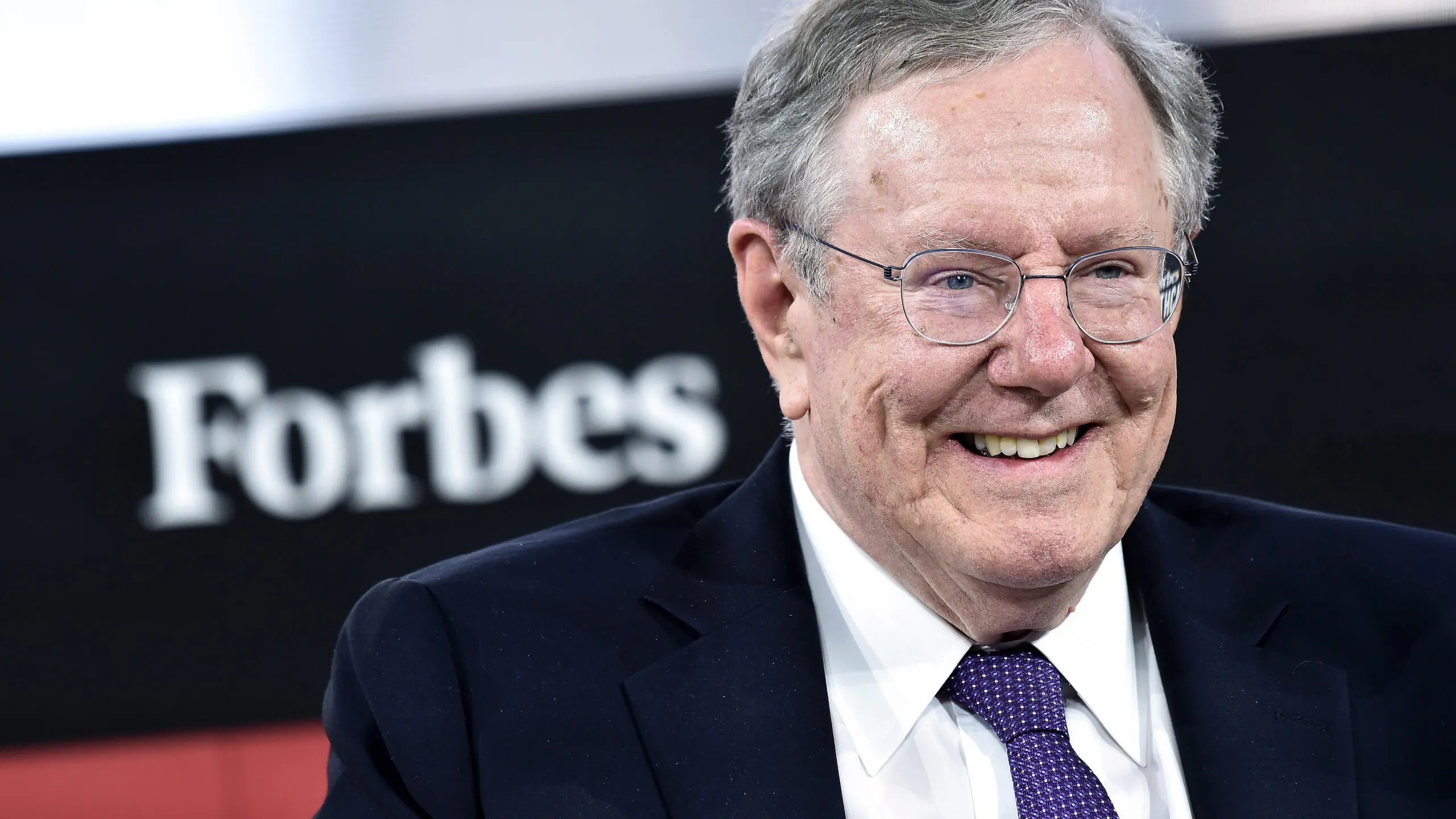

Steve Forbes, the chair of Forbes Media and editor-in-chief of Forbes Magazine, argued on Monday that monetary policymakers are neglecting currency stabilization as a tool to combat inflation.

Price levels between August 2021 and August 2022 rose 8.3%, according to data from the Bureau of Labor Statistics, marking a slight moderation from an 8.5% year-over-year increase in July and a 9.1% year-over-year increase in June. The Federal Reserve responded on Wednesday by increasing the target federal funds rate by 0.75% — a move that mirrored identical aggressive rate hikes in June and July.

Raising interest rate targets has the effect of discouraging economic activity by increasing the cost of borrowing money. During the Forbes Global CEO Conference in Singapore, Forbes questioned the logic of sending the economy into a recession in order to reduce inflationary pressures, according to a report from CNBC.

“No central banker today — hardly any — talks about stable currencies. It’s about depressing the economy to fight inflation,” he remarked. “With unstable currencies you get less productive long-term investments, which is key to economic growth.”

Currency appreciation leads to more costly exports for overseas buyers, according to an analysis from the International Monetary Fund. The dollar has appreciated rapidly against foreign currencies such as the euro amid the repeated interest rate hikes, decreasing demand for American products and lowering economic output.

“Today, unfortunately, not only is the Biden administration putting up obstacles to deal with supply-side problems, but also the Federal Reserve and other central banks think you have to depress the economy to bring inflation down,” Forbes added. “The real cure is to stabilize the currency. You don’t have to make people poor to conquer inflation.”

Forbes cited former President Ronald Reagan’s efforts to bolster American reserves of foreign currencies — a move that increases the supply of the dollar on foreign exchange markets, thereby decreasing exchange rates. Unpredictable exchange rates also increase currency risks for overseas investors, leading to less foreign direct investment into the United States.

Forbes, who ran for the Republican presidential nomination in 1996 and 2000, likewise suggested a return to the gold standard. “Gold holds its intrinsic value better than anything else on earth… gold is not perfect as a stable value, but it is better than anything we have found in over 4,000 years,” he explained.

To stimulate the economy during the lockdown-induced recession, the Federal Reserve had initially pegged a near-zero target interest rate and acquired government bonds from the market. The rollback of the stimulus from policymakers occurs as price levels rise at the fastest rate in four decades.

Federal Reserve Chair Jerome Powell said during a hawkish speech at the central bank’s symposium in Jackson Hole, Wyoming, that officials are prepared to “bring some pain” to combat rising price levels and return inflation to the long-term target of 2%. “Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy,” he asserted. “Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”

The Dow Jones Industrial Average, which tracks 30 of the most prominent companies on American exchanges, tumbled more than 500 points after the Federal Reserve hiked interest rate targets last week.

.png)

.png)