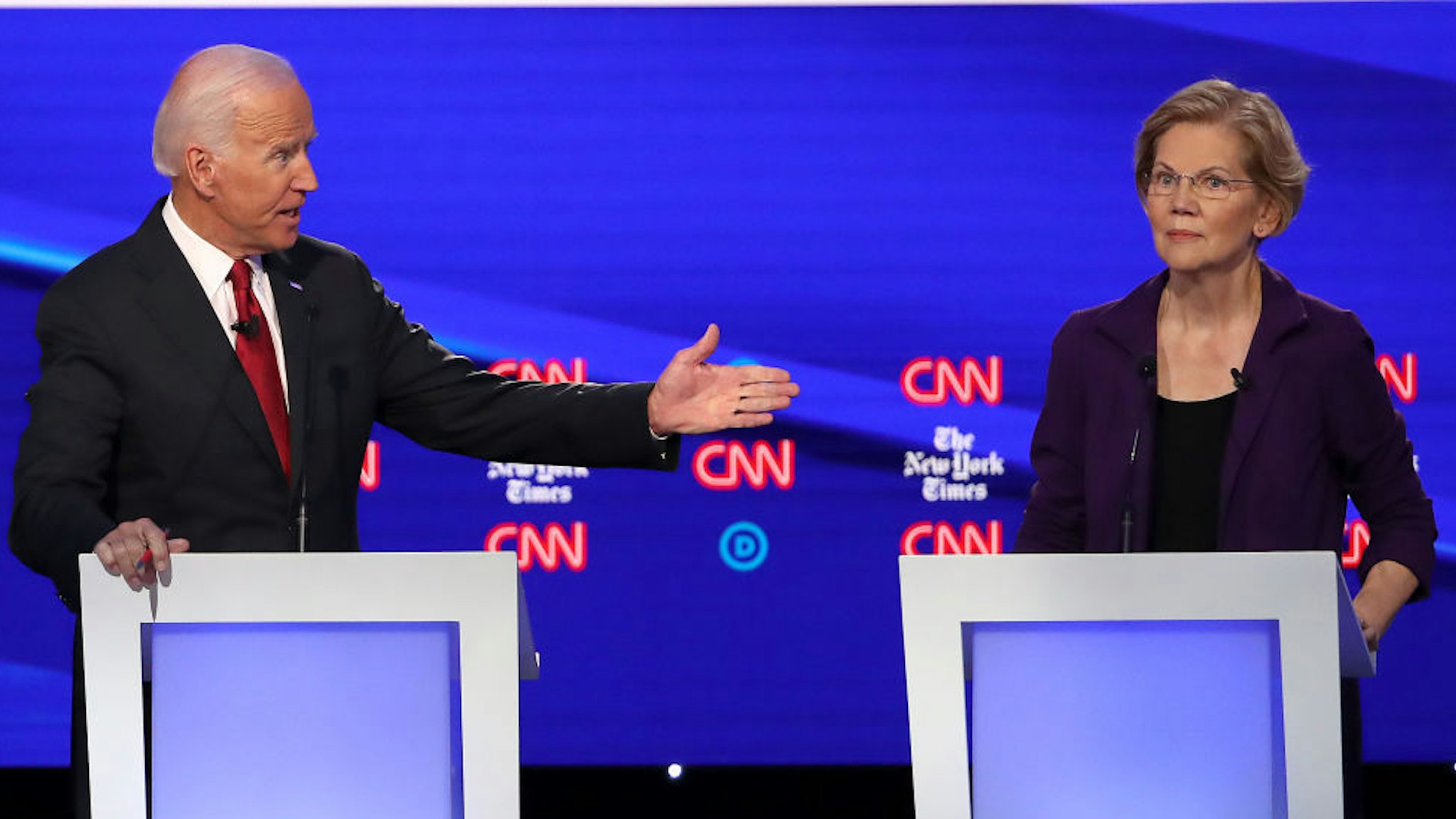

Things got a little heated during the fourth Democratic presidential primary debate in Ohio Tuesday night when former Vice President Joe Biden and Massachusetts Sen. Elizabeth Warren — who are locked in a statistical dead heat for the nomination — sparred over who should get credit for the creation of the Consumer Financial Protection Bureau.

In a back and forth Politico has deemed “one of their tensest exchanges yet,” Warren initially celebrated her own role in the creation of the CFPB, which was part of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, the massive reform bill passed in response to the 2008 crash.

“Following the financial crash of 2008, I had an idea for a consumer agency that would keep giant banks from cheating people,” Warren said of the bureau, the idea for which she developed during her tenure at Harvard University. “All of the Washington insiders and strategic geniuses said, ‘Don’t even try because you will never get it passed.’ And sure enough, the big banks fought us. The Republicans fought us. Some of the Democrats fought us. But we got that agency passed into law.”

But Biden wouldn’t sit back and let Warren pat herself on the back too long and made sure he got a piece of CFPB action.

“I went on the floor and got you votes,” he shoutingly asserted. “I got votes for that bill. I convinced people to vote for it, so let’s get those things straight, too.”

Warren responded by putting Biden in his place — under Barack Obama.

“I am deeply grateful to President Obama, who fought so hard to make sure that agency was passed into law,” the senator said.

Biden wouldn’t let her finish her next line, in which she was expressing general gratitude for those who helped get the bill passed, interjecting in a condescending way, “You did a hell of a job in your job.”

While Biden and Warren are both clearly quite proud of the positively named bureau, according to some analysts, the CFPB has actually hurt many of the consumers it’s supposed to “protect” and has been given a troubling amount of authority with very little oversight.

In a 2015 op-ed for George Mason University’s Mercatus Center, former senior fellow Hester Pierce explained why the CFPB is “not what it was hoped to be.”

“The CFPB was created by Dodd-Frank to protect consumers as they engage in financial transactions. The complexity and importance of consumer financial products and services, the champions of the bureau reasoned, warranted the formation of a new agency charged specifically with looking out for consumers’ best interests,” wrote Pierce. “The reality is not so rosy.” The article continues:

The bureau’s actions, although intended to protect consumers, harm them by limiting their options and raising their costs. Consumers with the fewest options — consumers in the most precarious financial circumstances — are particularly vulnerable to the bureau’s supposedly protective initiatives. Consider, for example, the difficulties that families attempting to buy or sell a manufactured home now face because of rules that block the types of mortgages that are commonly available for these homes. Admittedly, manufacturing housing loans are high-cost, but they are also high-risk. For a would-be buyer, the alternative might be an even more costly rental apartment.

Or consider the bureau’s planned proposals for payday and other consumer loans. Among other things, “lenders would have to determine at the outset of each loan that the consumer is not taking on unaffordable debt.” The contemplated requirements would make those loans much more work-intensive for lenders, would expose lenders to additional legal liability and would likely drive some lenders out of business altogether.

The heart of the problem, Pierce suggests, is that the bureau and its creators, including Warren, “operate under the assumption that the consumer financial contracts in use today are a zero-sum game,” which reductively views the financial company as the supposed “winner” and the consumer the “loser.” But that’s not how a voluntary exchange works, Pierce explains: “In a voluntary exchange, both the consumer and the company benefit when a consumer takes out a loan,” with the consumer gaining access to money he or she wouldn’t have had and the company benefiting by future payment with interest.

Pierce goes on to cite a Washington Post op-ed by economist Tom Durkin and Professor Todd Zywicki, who point out that “credit is a powerful tool for American families” and explain that “[e]liminating access to preferred products doesn’t eliminate the need for credit.” They also note that Warren has her facts wrong when it comes to the concept of debt:

As then-professor, now senator, Elizabeth Warren expressed the sentiment in 2004: “The [credit card] industry has no evidence that people were being turned down for loans in the early 1980s. What they have is evidence that people more often in the early 1980s preferred to pay cash than to pay on credit.”

In fact, that’s not what the evidence shows. Although Warren is right that fewer consumers used credit cards before the 1980s, that does not mean that they were instead paying with cash. In fact, the great explosion in consumer credit use was in the postwar period, as Americans abandoned their cramped city apartments and moved to the three-bedroom ranch in the suburbs – with a mortgage, a new car in the garage and all the latest appliances and furnishings, all bought “on time” (according to the advertising slogan of the era).

In a 2016 op-ed for The New York Times, Marshall Lux and Robert Greene, of the Mossavar-Rahmani Center for Business and Government at Harvard’s John F. Kennedy School of Government, explained how the big reform bill that introduced the CFPB “is hurting community banks”:

With more than 22,000 pages of regulations, the destabilizing consequences of the Dodd-Frank Wall Street Reform and Consumer Protection Act are numerous. One notable concern is that the law has forced consolidation of the United States banking system. The number of community banks (those with less than $10 billion in assets) shrank 14 percent between Dodd-Frank’s passage in 2010 and late 2014. Surely, consolidation is driven by many factors, some of which are good. It is also no recent trend, but neither is regulatory growth: between 1997 and 2008, banking regulations grew 18 percent.

When regulations — not consumers — drive consolidation, banking system risk increases. Dodd-Frank’s “Wall Street” focus snares community banks in an increasingly complex web of rules designed for larger banks. As such, the law forces well-managed institutions to unnecessarily divert resources to compliance (survey data shows community banks are doing just that), or worse, to close their doors. Minneapolis Fed research suggests that adding just two members to the compliance department would make a third of the smallest banks unprofitable.

Prager University released a video in 2017 on the problems surrounding the CFPB: