Bitcoin is becoming increasingly relevant on both Wall Street and Main Street.

The cryptocurrency — which exists entirely online — is a decentralized asset protected by encryption. Like government-backed “fiat” currencies, users can exchange Bitcoin for goods and services through digital wallets. Unlike fiat currencies, though, Bitcoin has not yet attained broad acceptance.

The latter reality, however, is quickly changing. Fortune 500 companies and sovereign wealth funds are beginning to accept Bitcoin for purchases and investing in cryptocurrency for long-term value. Now, some financial professionals are creating vehicles by which investors can bet on Bitcoin through traditional stock exchanges.

Business moguls are also bullish on the cryptocurrency’s future.

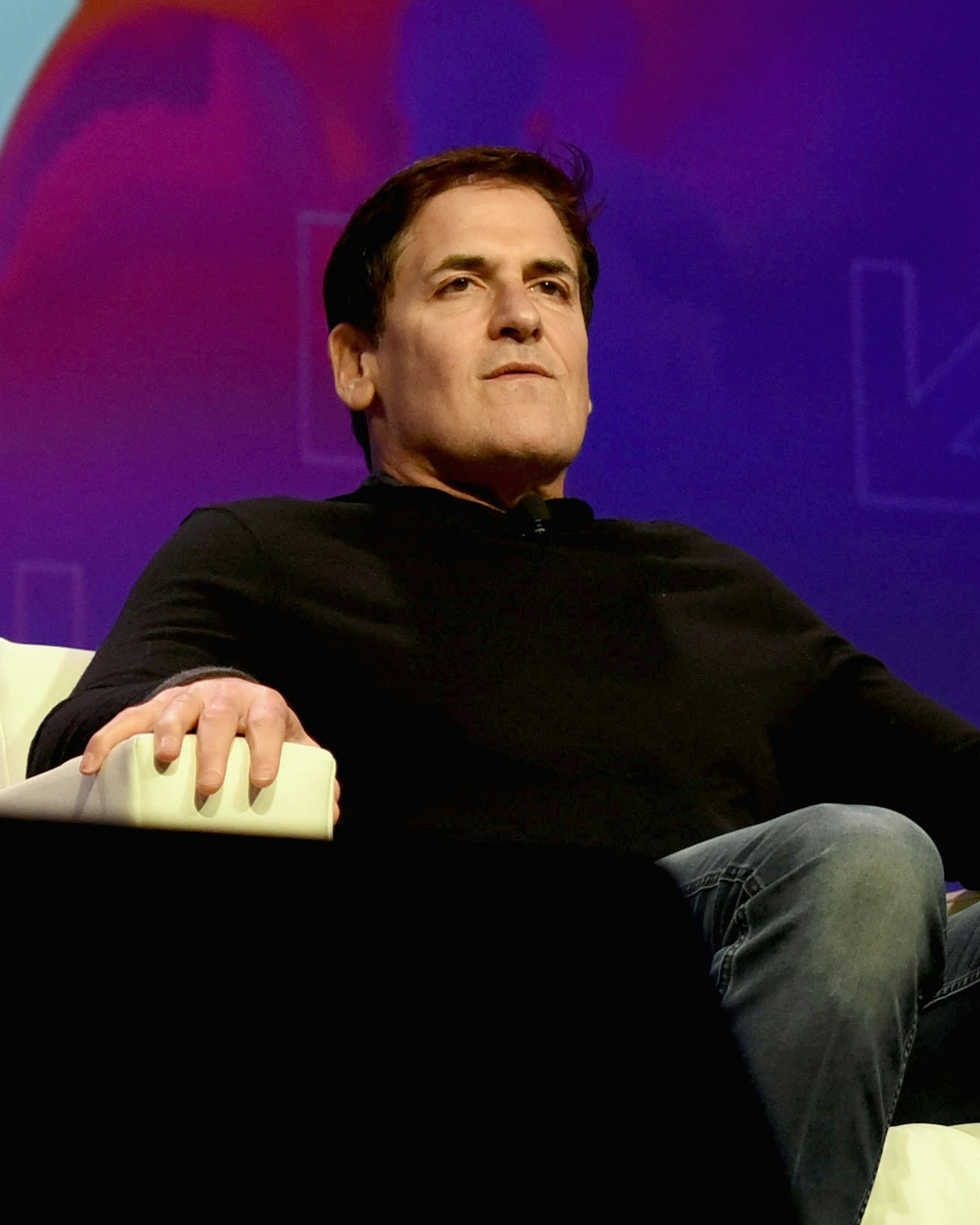

Mark Cuban

Dallas Mavericks owner and famous “Shark Tank” investor Mark Cuban calls Bitcoin “digital gold.”

“It wins that use case,” Cuban tweeted on June 21. “Every other platform from Eth to you name it will win or lose based on their user base. Over time, as happened with tech stocks, people will understand the valuation metrics of networks/platforms and invest based them.”

“Crypto outperforms stocks not just on transparency, but by allowing tokens to share all the economics with holders,” he continued. “Revenues always get to holders, not to retained earnings. That’s huge. The economics of apps and innovation are far better for entrepreneurs and investors.”

Cuban has also touted Bitcoin’s perceived advantages over precious metals, which have served as hedges against inflation for centuries.

“Its BETTER than gold,” Cuban added. “No worries about storing it. Easy to transfer. Easy to trade. Easy to convert. Doesn’t require an intermediary. Can be fractionalized.”

Tim Draper

Venture capital investor Tim Draper believes Bitcoin will hit $250,000 within the next several months.

“I think I’m going to be right on this one,” Draper told CNBC. “I’m either going to be really right or really wrong [but] I’m pretty sure that it’s going in that direction.”

“Give it about a year and a half and retailers will all be on Opennode [a bitcoin payment processor], so everybody will accept bitcoin,” he predicted. “Then beyond that, I think [Bitcoin] continues up because there are only 21 million of them.”

Draper conjectured that Bitcoin’s role in cryptocurrency will be comparable to Microsoft and Amazon’s roles in the software and e-commerce industries.

Ricardo Salinas Pliego

Mexican billionaire Ricardo Salinas Pliego endorsed Bitcoin as a valid investment.

Repeating Cuban’s assertion that “Bitcoin is the new gold,” the businessman — who runs the conglomerate Grupo Salinas — said that the cryptocurrency is “a great way to diversify your investment portfolio, and I think that any investor should start to study cryptocurrencies and their future.”

“The secret of investing in #Bitcoin is to buy now and not to sell,” said Salinas. “Only sell with a specific purpose or out of necessity… and if you invest well, the latter will not happen.”

Michael Saylor

MicroStrategy founder Michael Saylor led his company to purchase $489 million in Bitcoin.

“We rotated our shareholder base and transformed ourselves into a company that’s able to sell enterprise software and to acquire and hold bitcoin, and we’ve done it successfully with leverage,” Saylor told CNBC. “That has increased the power of the brand by a factor of 100. We just had our best software quarter… in the last 10 years last quarter… The bitcoin business is driving shareholder returns. I think the employees are happy. The shareholders are happy.”

“As of 6/21/21 we #hodl ~105,085 bitcoins acquired for ~$2.741 billion at an average price of ~$26,080 per bitcoin,” he recently announced on social media. The tag “hodl” — popular with cryptocurrency traders — is translated as “hold on for dear life.”

Elon Musk

Perhaps most famous of all, Tesla CEO Elon Musk led his firm into purchasing Bitcoin — and accepting it as payment.

“You can now buy a Tesla with Bitcoin,” Musk wrote in late March. “Tesla is using only internal & open source software & operates Bitcoin nodes directly.”

Furthermore, the entrepreneur promised that “Bitcoin paid to Tesla will be retained as Bitcoin, not converted to fiat currency.”

Musk, however, walked back the move after citing concern over the use of fossil fuels in Bitcoin mining: “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment. Tesla will not be selling any Bitcoin and we intend to use it for transactions as soon as mining transitions to more sustainable energy. We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Most recently, Musk added that Tesla only sold 10% of its Bitcoin reserves to “confirm BTC could be liquidated easily without moving market.” Tesla will continue with Bitcoin transactions after executives are confident that at least 50% of mining energy comes from green sources.

The views expressed in this opinion piece are the author’s own and do not necessarily represent those of The Daily Wire.